Recurring revenue. It’s the north star of the modern economy. Predictable income, higher customer lifetime value (CLV), and sky-high business valuations. Every board wants it; every competitor is launching an “as-a-service” model.

So why, for so many CFOs and operations leaders, does the dream of predictable revenue feel more like a recurring nightmare?

If your finance team is buried in spreadsheets, your billing department is issuing endless corrections, and your sales team can’t get a clear answer on a renewal quote… you’re not alone.

You’re experiencing Recurring Chaos. And it’s a sign that your back-office systems are holding your business model hostage.

The ‘Chaos’ Is a Symptom. Your Systems Are the Cause.

This chaos doesn’t come from a lack of effort. It comes from a fundamental disconnect. Your business is trying to run a 21st-century subscription model on 20th-century technology.

Specifically, your Enterprise Resource Planning (ERP) system—your financial core—was built for a “one-and-done” world. It’s a master at shipping a product and booking the revenue.

But a subscription is not a single transaction. It’s an ongoing relationship. It’s a series of events: amendments, upgrades, downgrades, usage-based charges, renewals, and suspensions.

This is where the chaos begins. You can feel the symptoms long before you diagnose the problem:

-

- The Infamous “Wall of Spreadsheets”: Your finance team exports data from 3+ systems, manually reconciles it in Excel, and prays the MRR report is accurate—all to meet ASC 606/IFRS 15 revenue recognition guidelines.

-

- Billing Errors & Customer Churn: You’re accidentally overcharging, undercharging, or billing for the wrong entitlements. Every billing error is a “trust-buster” that sends your customers shopping for competitors.

-

- Glacial Time-to-Market: The product team wants to launch a new “pay-as-you-go” bundle. The C-suite loves it. But IT and Finance say it will take six months to “re-code the billing logic.”

-

- Operational Gridlock: You have armies of smart people performing “swivel-chair” integration—manually keying in renewal orders from your CRM (like Salesforce) into your ERP (like Oracle or NetSuite).

This isn’t a scalability problem. It’s a structural one.

Quick Self-Check: Is Your Process at a Breaking Point?

Do these symptoms feel a little too familiar? It can be hard to tell the difference between temporary “growing pains” and a fundamental system breakdown.

We created a 5-point checklist to help you quickly diagnose the health of your quote-to-revenue process. Use it to see if your current systems are built to scale, or if it’s time to explore a modern solution.

Take the 2-Minute Checklist to evaluate your current system.

The Root Cause: The Chasm Between ‘Quote’ and ‘Revenue’

The problem lives in the gap between your front office and your back office.

-

- Your CRM (Front Office) knows what was promised to the customer.

-

- Your ERP (Back Office) knows what was billed and what revenue was recognized.

In a subscription model, these two systems are in a constant, high-speed conversation. But for most companies, they don’t speak the same language. This broken workflow is the quote-to-revenue (Q2R) process.

This chasm is where value leaks. It’s where compliance risk is born. It’s where your customer experience goes to die.

You can’t fix this with more plug-ins. You can’t fix this with more spreadsheets. You have to fix the process.

The Cure: A Unified Subscription Lifecycle Management Platform

To move from chaos to control, you need a system that acts as the single source of truth for the entire subscription lifecycle. You need a bridge that natively connects your CRM and your ERP.

This is the role of a modern subscription management solution. It’s not just a “billing tool.” It is the central engine for your entire quote-to-revenue process.

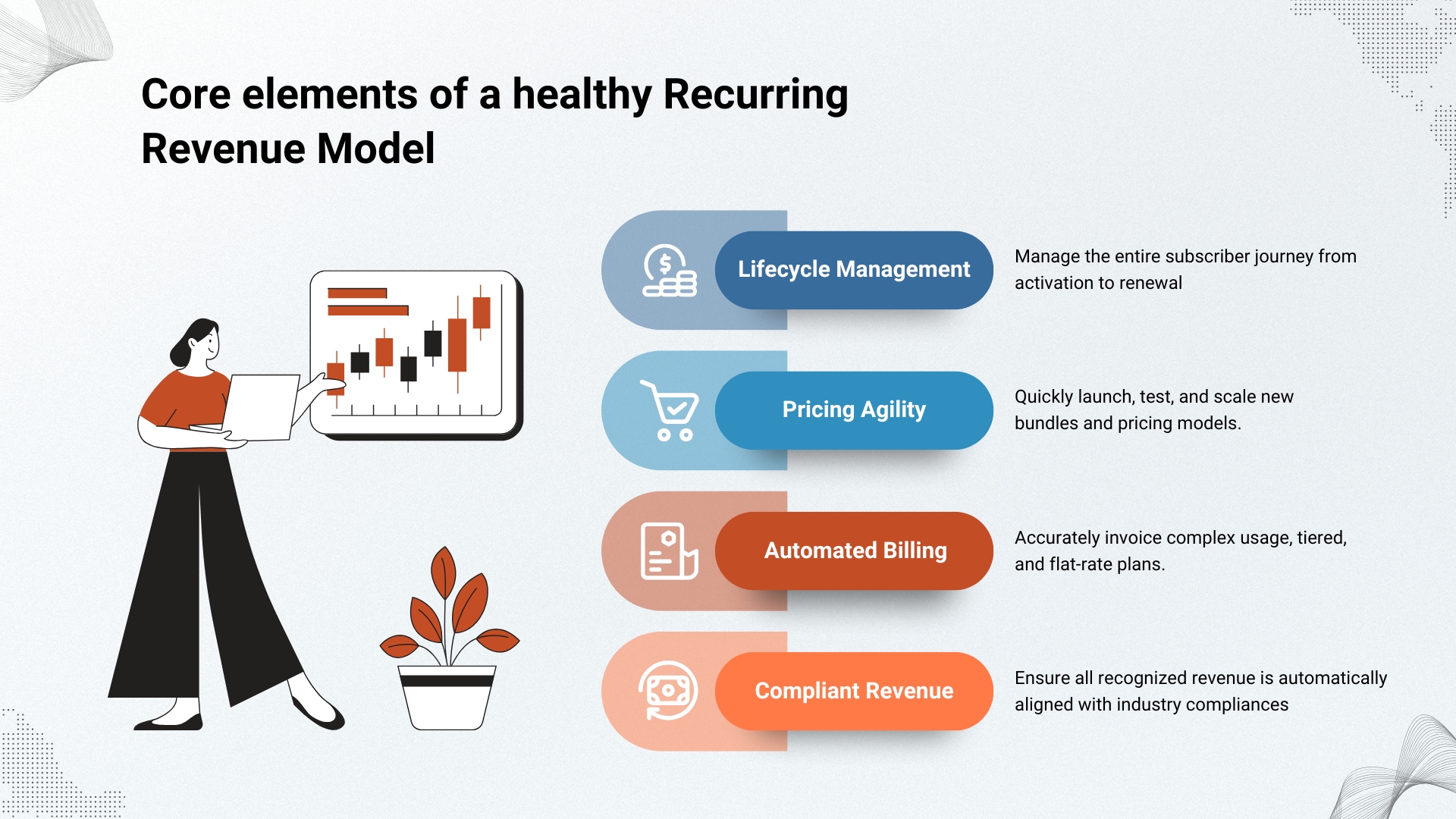

A unified platform does four things your current stack can’t:

-

- It Centralizes the Contract: It creates one “master record” for every subscription. When Sales makes an amendment in the CRM, that change flows instantly to Finance and Operations without manual entry.

-

- It Automates Complex Billing: It handles any model you can dream up—usage-based, tiered, bundled, prorated—and automatically generates accurate invoices.

-

- It Masters Revenue Recognition: It automates the complex revenue allocations and waterfalls required by ASC 606, turning a 4-day manual process into an automated, audit-proof report.

-

- It Manages the Full Lifecycle: From activation to renewal to dunning (managing failed payments) and churn, the platform manages every commercial event in the customer relationship.

The Strategic Advantage: Connecting CX Directly to Your ERP

The ultimate solution is a platform that was designed to speak the language of your financial system.

This is where Oracle CX Subscription Management creates a powerful, strategic advantage. It’s not a third-party application trying to “sync” with your back office. It is part of the same native, integrated suite as your Oracle ERP Cloud or NetSuite.

When your subscription management platform and your General Ledger are part of the same family, the “chasm” disappears.

-

- The quote from Oracle CX Sales creates a subscription.

-

- That subscription instantly and accurately informs the billing and revenue schedules in your Oracle ERP.

-

- There is no reconciliation. There are no data silos.

-

- There is one single source of truth for every dollar.

From Recurring Chaos to Recurring Confidence

The “as-a-service” economy isn’t slowing down. The only question is whether your systems can keep up.

Stop asking your team to patch a broken process. Stop accepting spreadsheet-based finance as “the cost of doing business.”

By unifying your quote-to-revenue process, you don’t just fix the chaos. You transform your business.

-

- Your CFO gets audit-proof books and predictable forecasts.

-

- Your CRO gets the agility to launch new pricing in days, not quarters.

-

- Your COO gets automated processes that can scale to millions of subscribers.

-

- And your customer gets a simple, transparent, and flawless experience.

Isn’t that what the recurring revenue dream was supposed to be about?

Take the Next Step

Don’t let legacy systems define your future. It’s time to move from chaos to control.

See what a unified quote-to-revenue process looks like in action. Explore Oracle CX Subscription Management with SPL. Let’s Talk

Frequently Asked Questions (FAQs)

1. What is the quote-to-revenue (Q2R) process, and why is it broken for subscriptions?

The quote-to-revenue (Q2R) process covers the entire customer journey, from the initial sales quote to the final revenue recognition in your financial system. For subscription businesses, this process is often “broken” because legacy ERP and CRM systems can’t manage the constant change—amendments, upgrades, usage-based billing, and renewals. This creates data silos, forcing manual reconciliation and leading to errors.

2. Can’t my standard ERP handle subscription billing?

Most traditional ERPs were designed to “ship and forget”—they excel at one-time transactions. They are not built for the dynamic, ongoing nature of a subscriber relationship. They typically lack the flexibility to manage complex pricing, prorations, co-termed renewals, or the sophisticated revenue recognition rules (like ASC 606) required for recurring revenue models.

3. What is ASC 606, and why is it a challenge for subscription finance teams?

ASC 606 (and the global IFRS 15) is the accounting standard for revenue recognition. For subscriptions, it dictates that revenue must be recognized as the service is delivered, not just when the bill is paid. This is incredibly complex for bundles (e.g., hardware + service + support) or with mid-cycle changes. Without an automated system, finance teams are forced into manual, error-prone spreadsheets to remain compliant, which is a major audit risk.

4. What is the difference between a simple billing tool and a subscription management platform?

A billing tool sends invoices. A true subscription management platform manages the entire subscriber lifecycle. It handles complex pricing and quoting, provisions the service, automates the recurring billing, manages dunning (payment failures), and—most critically—automates the complex revenue recognition, all while integrating natively with your ERP and CRM.

5. How does Oracle CX Subscription Management connect to an ERP?

Oracle CX Subscription Management is designed to be the “subscription engine” that bridges your front-office CRM and back-office ERP. It is purpose-built to integrate deeply with financial systems like Oracle ERP Clou. This creates a single, unified data model, eliminating manual entry and ensuring that what sales sold, what the customer is using, and what finance is recognizing are always in perfect sync.